CURRENT PROJECTS

FNWD Meadows LLC

FNWD Brookstone LLC

FNWD Brookstone 2 LLC

FNWD Brookstone 3 LLC

FNWD Deer Haven LLC

PAST PROJECTS

Rosecroft Investments, LLC

FNWD Land Acquisition & Development I LLC

FNWD Investment I LLC

Brighton Court Properties, LLC

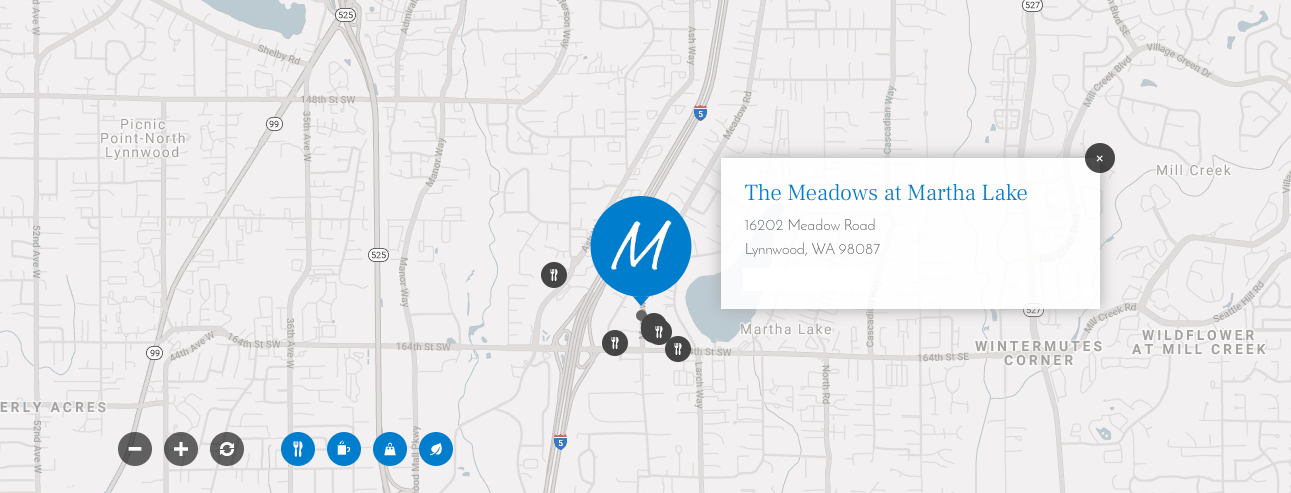

FNWD Meadows LLC

63-unit apartment project in Lynnwood (16202 Meadow Road)

63-unit apartment project in Lynnwood (16202 Meadow Road)

- Acquired entitled 3-acre property from FNWD Land A&D for $3.35mm in July 2015

- Raised $6.65mm in equity and $10mm construction loan

- Constructed, leased up and continue to operate the project

- Received final Certificate of Occupancy in July 2017; Started leasing November 2016 and completed lease up in September 2017.

- After lease up converted to permanent financing of $12.5mm in November 2017

- 8% preferred return paid through Q4 2017; paying 1%/quarter and accruing 1%/quarter from 2018 forward

- Continuing to operate and increase NOI to position for sale

- www.themeadowsatmarthalake.com

FNWD Brookstone LLC

24-unit apartment project in Wenatchee (1686 Stella Ave)

24-unit apartment project in Wenatchee (1686 Stella Ave)

- Acquired the occupied, 24-unit apartment building in March 2016 for $3.2mm

- Raised equity of $1.475mm and permanent financing of $1.98mm

- 7% preferred return paid from the outset.

- Continuing to operate and increase NOI

- Likely exit strategy is to sell together with FNWD Brookstone 2 LLC (Courtyard 465 Apartments)

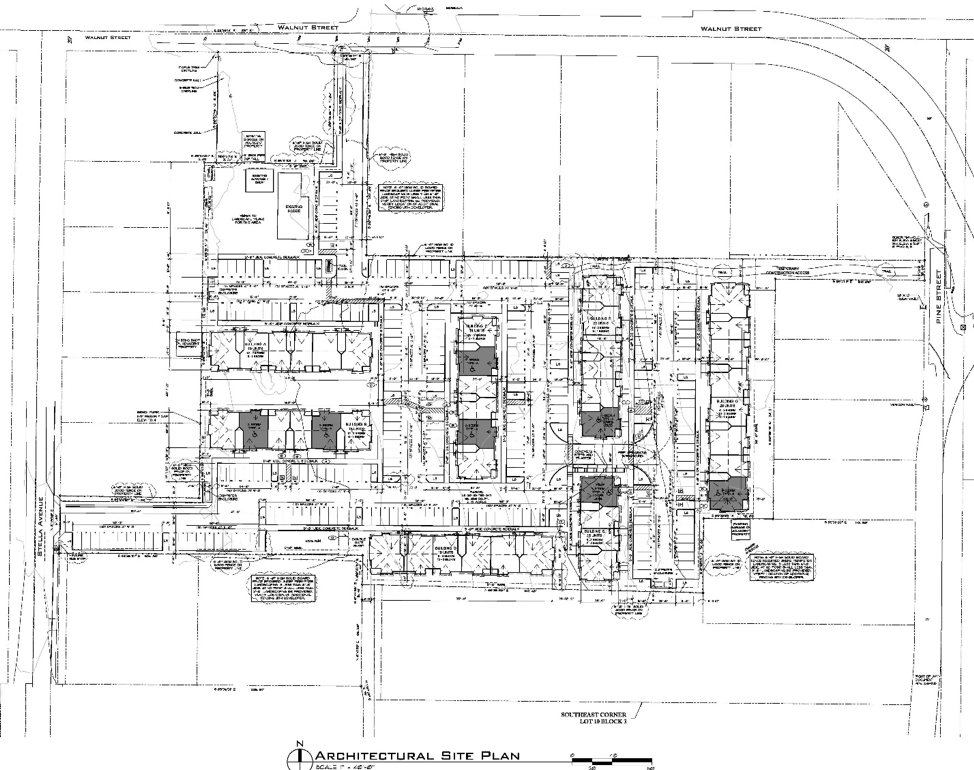

FNWD Brookstone 2 LLC

65-unit apartment project in Wenatchee (1688 Stella Ave)- Courtyard 465 Apartments

65-unit apartment project in Wenatchee (1688 Stella Ave)- Courtyard 465 Apartments

- Acquired 1.8 acres adjacent to the Brookstone Apartments for $1.7mm in March 2016

- Raised equity of $5mm and construction financing of $8mm

- Started construction August 2017. Received final COs in April 2019

- Constructed (under budget), currently leasing up and will continue to operate once stabilized

- 4.5% preferred return with targeted 12% IRR from original private offering. Expect to beat projections as actual rents are higher than projected and we were approved for an 8-year property tax abatement (new construction incentive) which was not included in the original private offering. Expecting to begin distributions in 2020.

- www.courtyard465.com

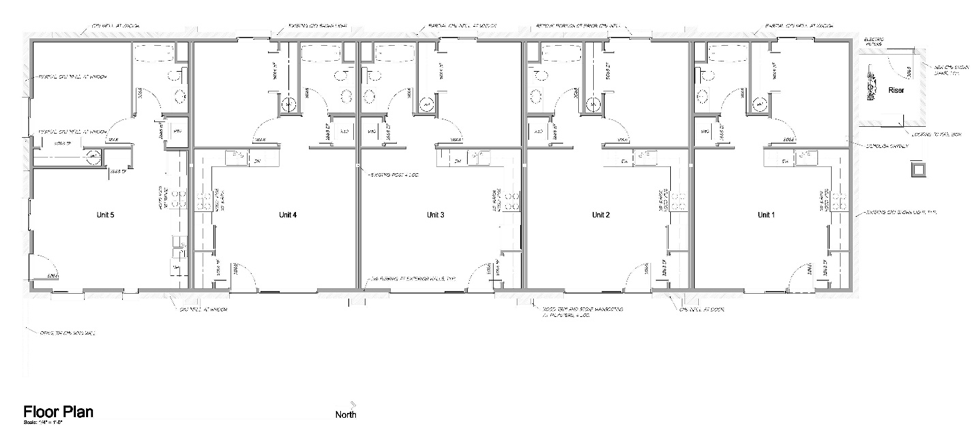

FNWD Brookstone 3 LLC

Existing warehouse in Wenatchee w/ potential for 5 apartment units

Existing warehouse in Wenatchee w/ potential for 5 apartment units

- Acquired 3,000 sq ft warehouse on 0.36 acres for $325,000 in January 2018

- Raised equity of $450,000

- Utilized as storage during construction of Courtyard 465; received storage fee through May 2019

- In planning process to convert to 5 apartment units. Pre-application meeting on 9/26/19

FNWD Deer Haven LLC

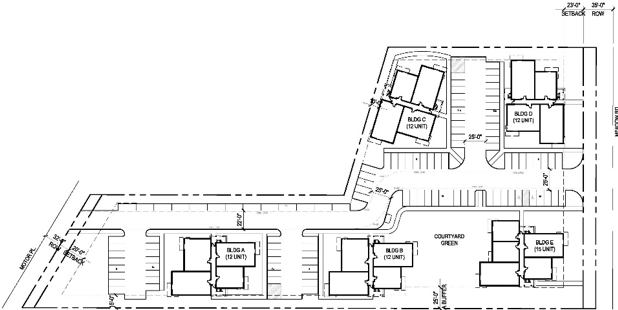

137-unit apartment project in Wenatchee (1705 Stella Ave) Deer Haven Apartments

137-unit apartment project in Wenatchee (1705 Stella Ave) Deer Haven Apartments

- Acquired 2 parcels in Q1 2018 for a total of 4.8 acres for $1mm with secured notes of $1.1mm (repaid with equity raise)

- Designed and entitled 137-unit apartment project; received initial building permits 9/12/19

- Raised equity of $8.315mm and construction loan of $19mm

- Hope to break ground in late 2019 or early 2020

ROSECROFT INVESTMENTS, LLC

40-units in a broken condo project (Entire plat made up of 21- fourplex townhomes for 84 total units) in Boise, ID; Bank owned property

40-units in a broken condo project (Entire plat made up of 21- fourplex townhomes for 84 total units) in Boise, ID; Bank owned property

- Acquired in January 2012 for a purchase price of $3mm

- Raised equity of $1.4mm; permanent financing of $2.25mm

- Completed punch list; completed lease up and operated until August 2017

- Cash out refinance in July 2013 in anticipation of acquiring additional 4-plex within the project; $2.525mm

- Acquired an adjacent 4-plex in August 2013 at trustee sale for $350,000

- Paid 4% preferred return from commencement, increasing to 5% in 2014

- Sold in August 2017 for combined sale price of $5,815,000

- Investors more than doubled their original investment over the nearly 5 years for a 20% IRR

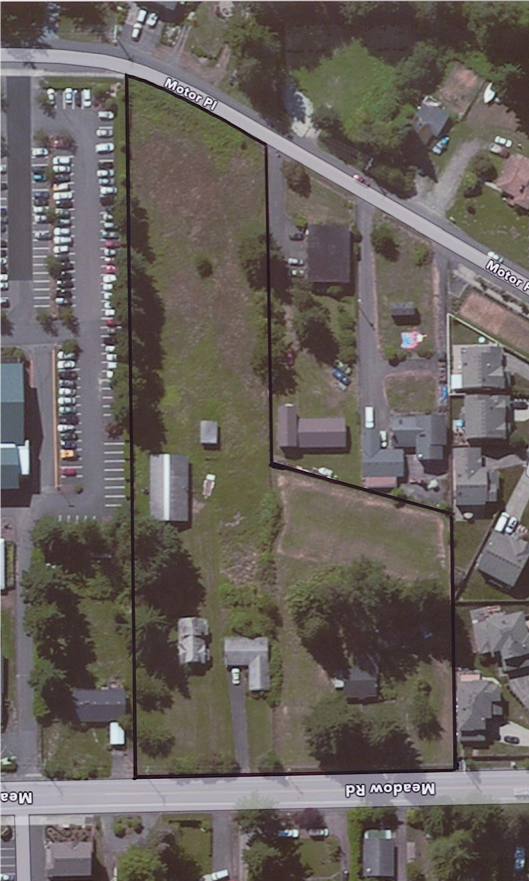

FNWD LAND ACQUISITION & DEVELOPMENT I LLC

Acquired land in Lynnwood for development of an apartment project

Acquired land in Lynnwood for development of an apartment project

- Acquired 2 acres in December 2012 for $945,000; acquired adjacent acre in April 2014 for $450,000

- Raised equity of $1.9mm and borrowed $500,000

- Initially entitled for 41 units but resubmitted with purchase of the additional acre and entitled for 63 apartment units

- Sold to related development company, FNWD Meadows LLC for $3.35mm in July 2015

- Investors earned 37.5% over the 2.5 years for a 15% IRR

FNWD INVESTMENT I LLC

Existing 8-unit apartment complex in North Queen Anne (57 W. Etruria St.)

Existing 8-unit apartment complex in North Queen Anne (57 W. Etruria St.)

- Acquired in December 2012 for a purchase price of $1.4mm

- Raised equity of $790,000; permanent financing of $790,000

- Operated, made small improvements and increased rents over 3 years

- Paid a 4% preferred return during operations

- Sold in December 2015 for $2.4mm

- Investors doubled their investment over the 3 years for an IRR of 33%

BRIGHTON COURT PROPERTIES, LLC - Shoreline, WA

- 1.2 acre property for apartment development

- Just off of Hwy 99 (Aurora Ave.) and 152nd

- Up to 130 units with secure, underground parking

- Entitled property and obtained tax abatement

- Increased value of the property and SOLD the land to another developer